None at all!

We’re a browser-based application which can be accessed on any internet-enabled device.

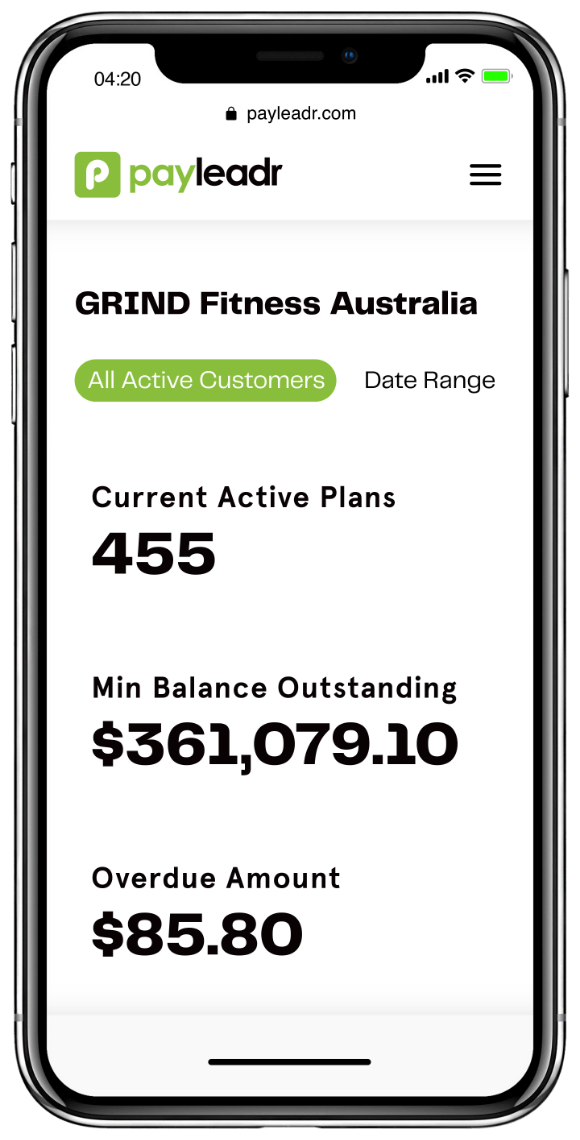

You can carry an automated accounts receivable platform in your pocket!

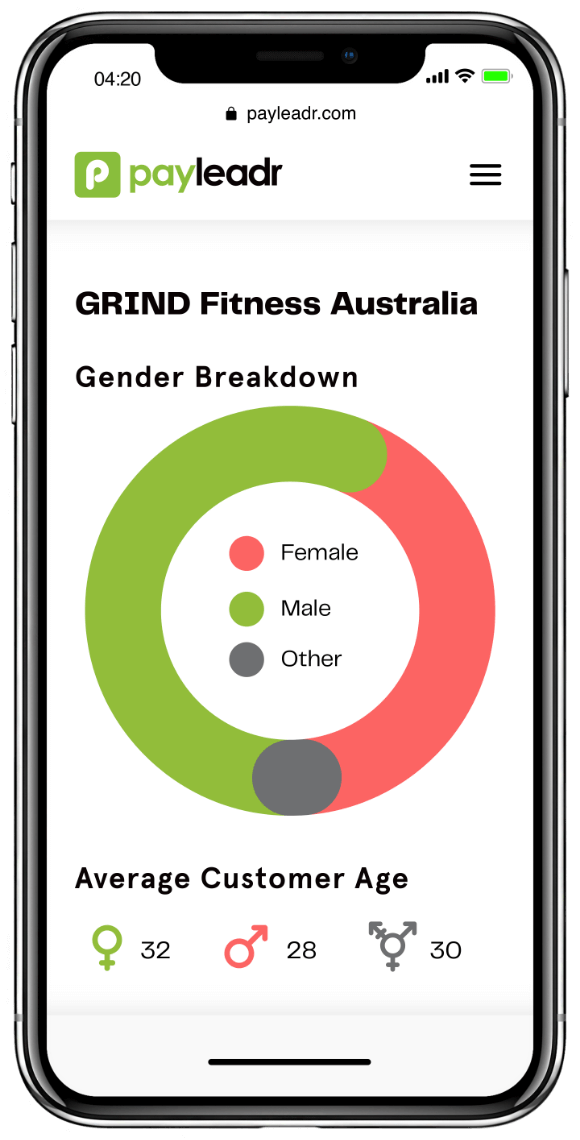

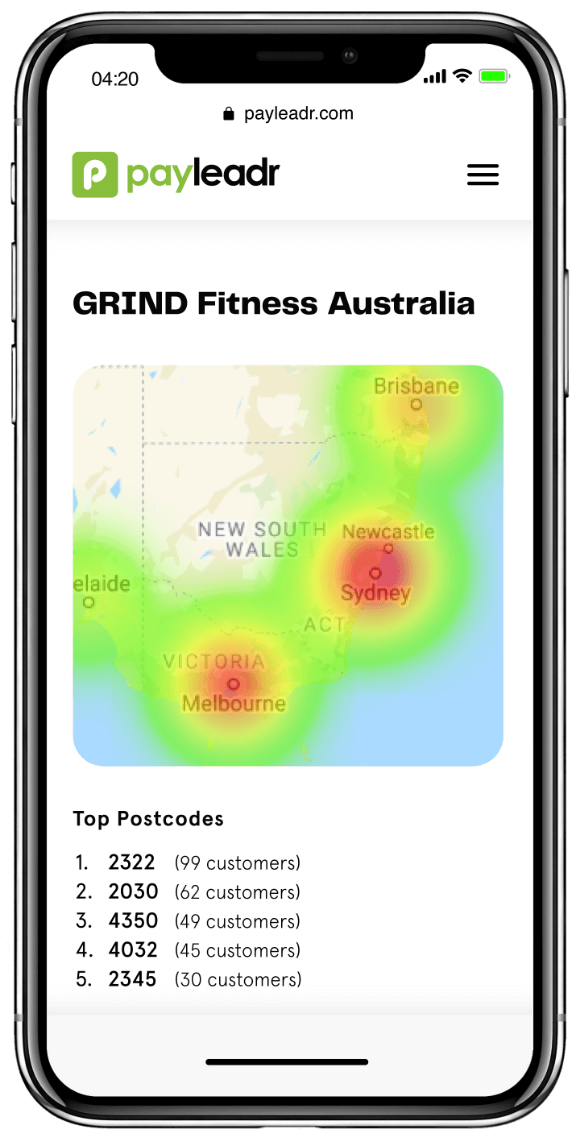

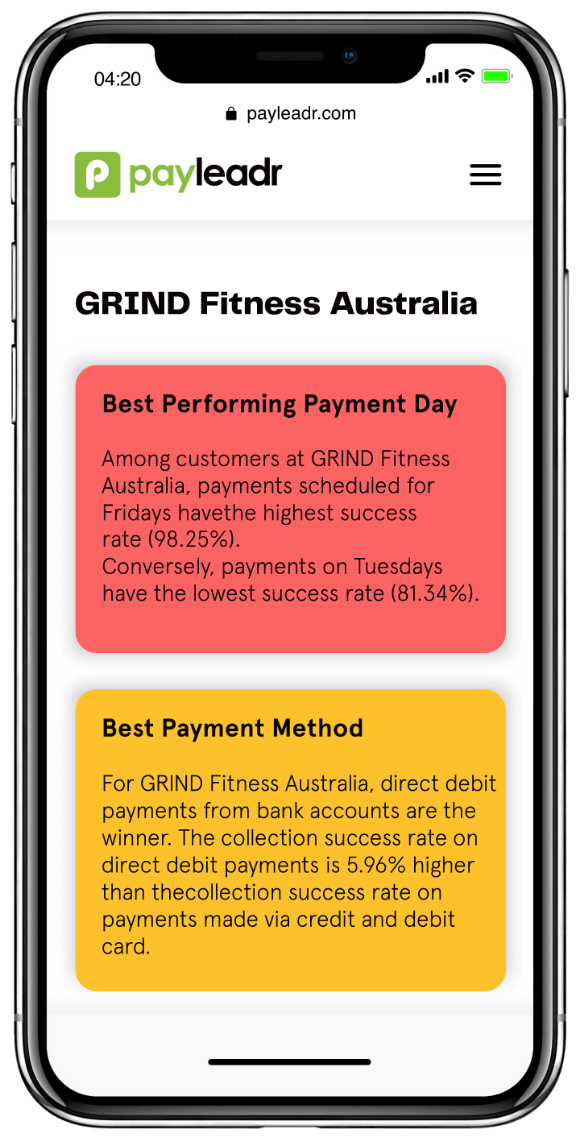

Create, promote and manage instalment payment plans with your customers, anywhere, anytime. Our actionable insights on how best to structure your payment plans help you maximise revenue and attract more customers.

By signing up, you agree to receive email newsletters and offers.

“We have had an awesome experience working with Payleadr to get our direct debit platform up and running before the opening of our business. We would not hesitate to recommend Payleadr to other businesses. The platform is straightforward and simple to use and the support staff are quick to help and respond to your queries.”

“The customisable nature of the platform has made it easy to integrate into our onboarding process. We love how the process can be entirely digital, enabling us to seamlessly set up direct debit arrangements with our clients all over Australia. We recommend Payleadr to any professional services business who is looking for an easy to use and effective way to manage their direct debit payments.”

“The customisable nature of the platform has made it easy to integrate into our onboarding process. We love how the process can be entirely digital, enabling us to seamlessly set up direct debit arrangements with our clients all over Australia. We recommend Payleadr to any professional services business who is looking for an easy to use and effective way to manage their direct debit payments.”

“Payleadr is the best platform I have ever used for memberships and payment plans”

None at all!

We’re a browser-based application which can be accessed on any internet-enabled device.

You can carry an automated accounts receivable platform in your pocket!

Relax, we’ve got that covered.

Using our platform does not require you to obtain any new or specialist e-commerce or direct debit facilities from your bank.

To quickly add, as the payments collected from your customers can be settled into any Australian bank account there is no need to make any changes to your existing banking relationships. Because that’s a punish.

Hell no, that’s “old school”, it’s 2020’s.

We do not believe in locking our clients into contracts, instead, we stand behind our product. You’re free to leave without penalty, at any time, for any reason, though we’re yet to see that happen.

This acts as an incentive for us to deliver great service and innovative features at a fair price. We believe it’s how modern businesses should be run.

As soon as the payment clears.

Visa and MasterCard debit and credit card transactions will be settled to you the next business day following the day of the transaction (for Visa and MasterCard payments processed Monday – Friday). Visa and MasterCard debit and credit card transactions processed on a Saturday or Sunday will be settled to you on a Tuesday. For direct debit payments, from a bank account, you receive the funds three business days after the transaction attempt.