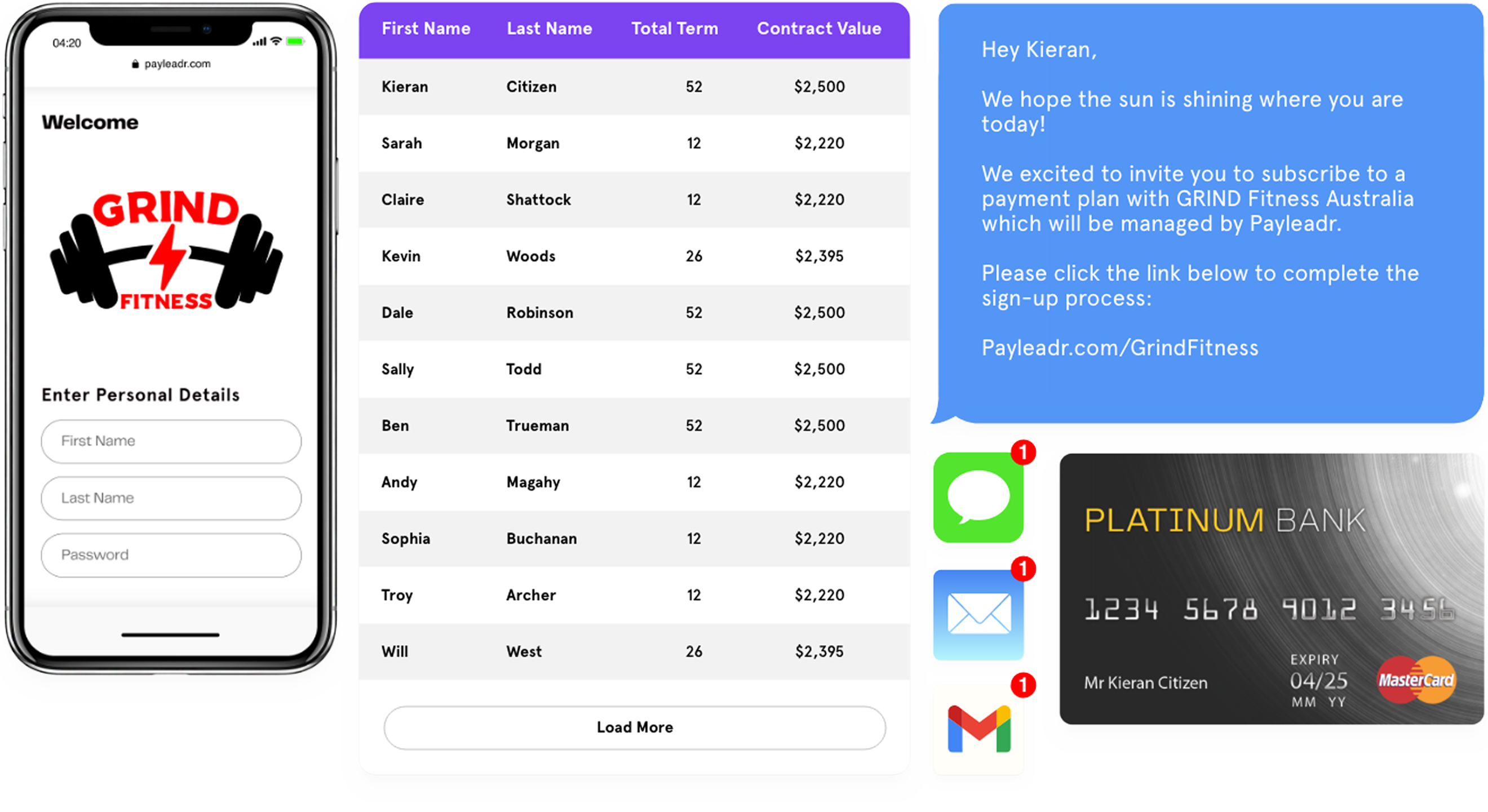

Built for modern businesses that collect recurring direct debits from customers - Payleadr facilitates seamless digital payments.

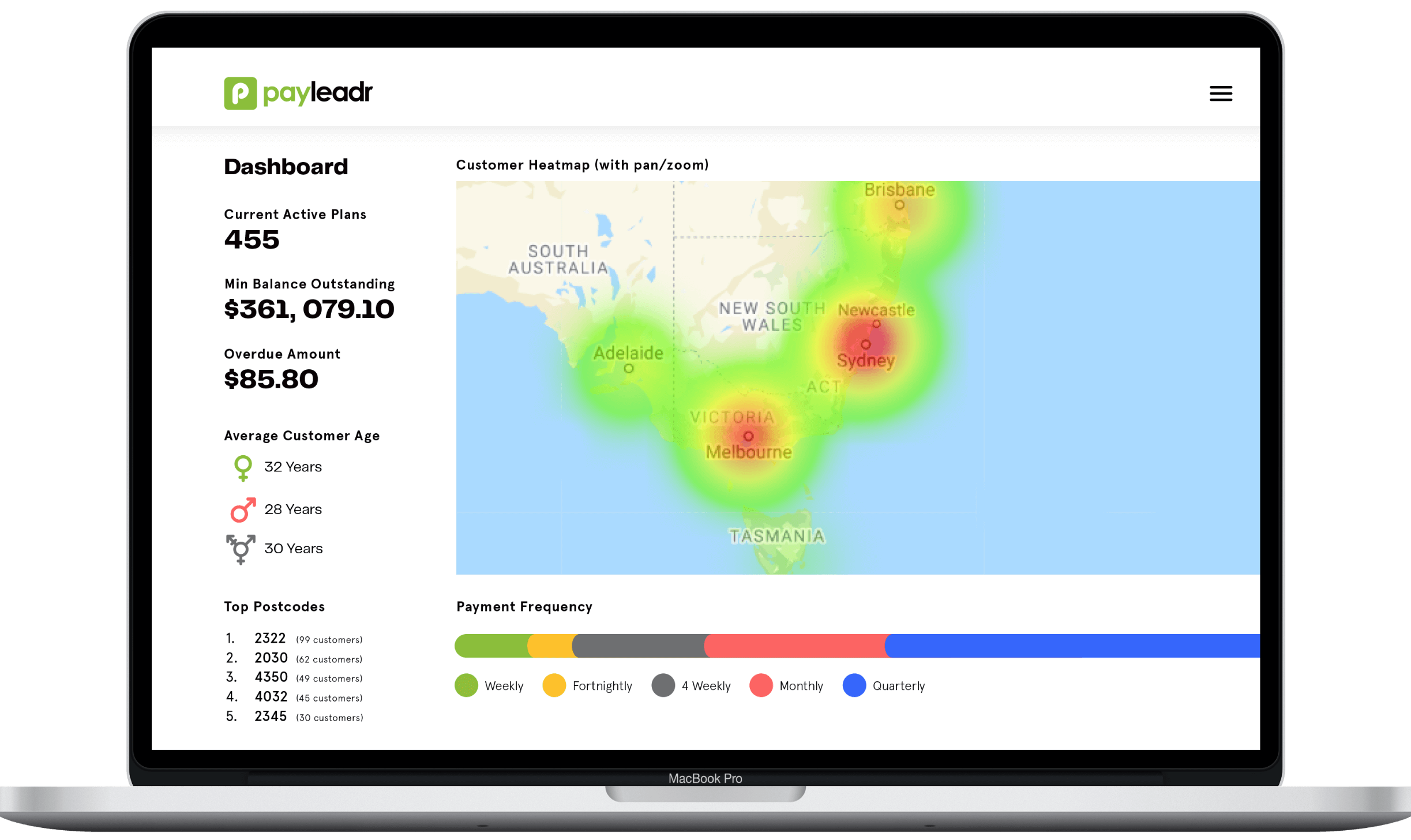

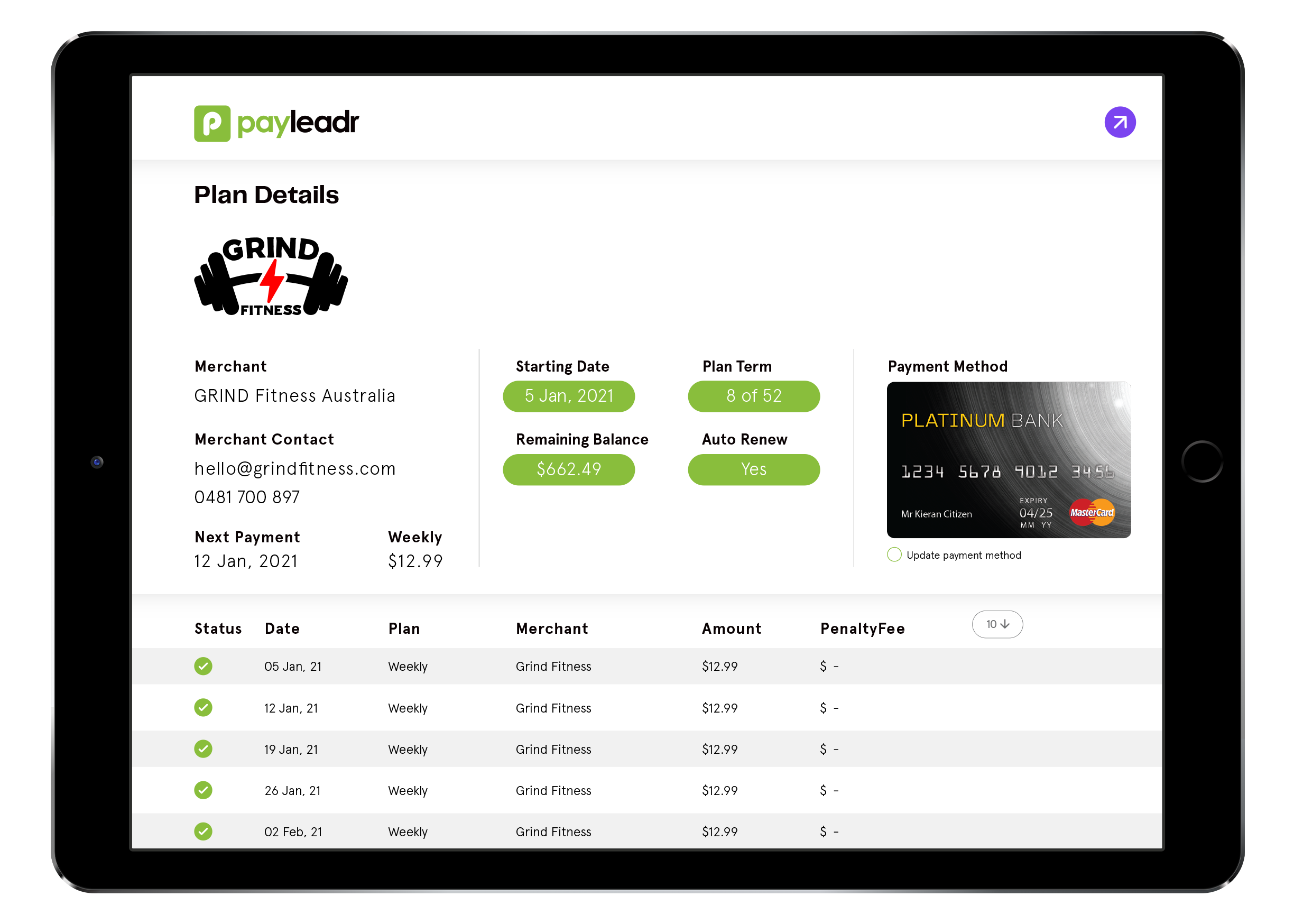

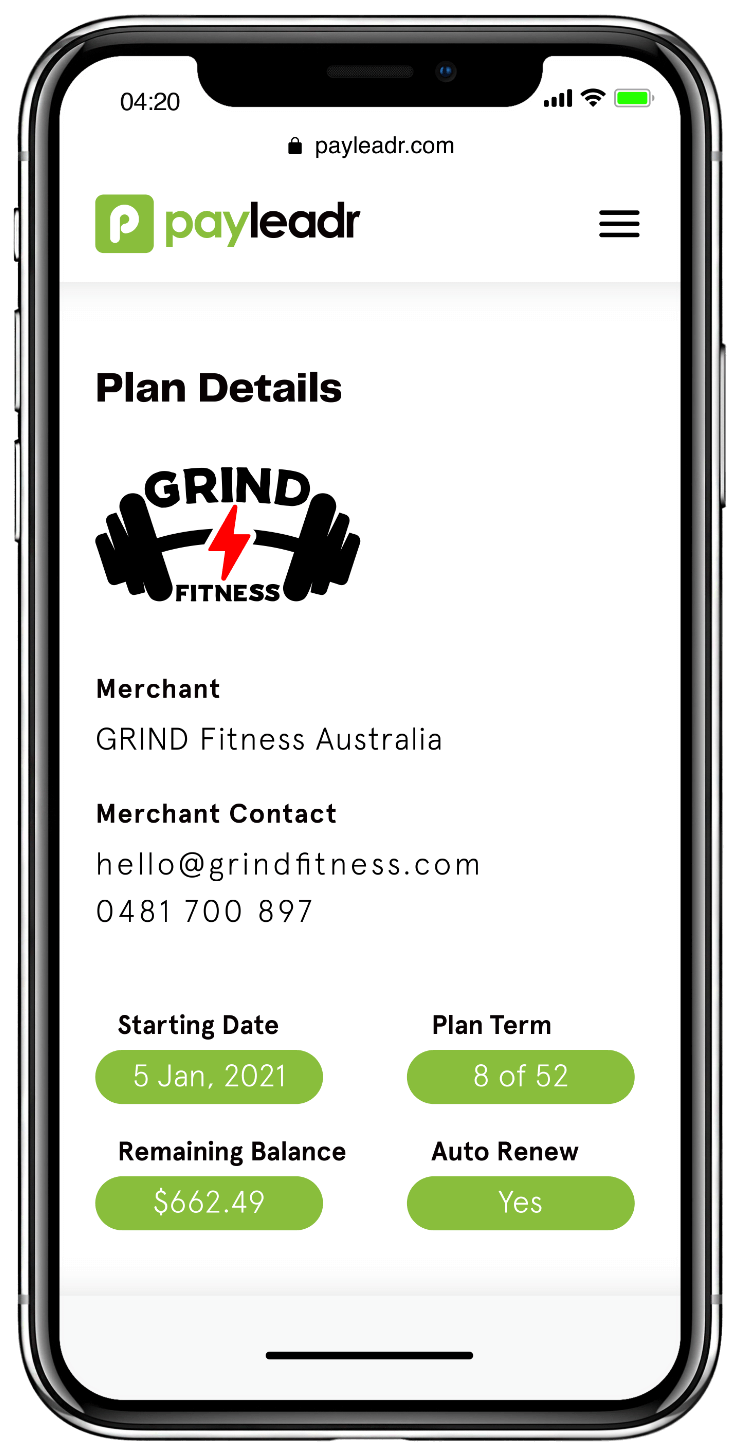

We offer real value to our clients because we make collecting direct debit payments easier than ever before. We utilise the latest in cloud technologies and provide online payment portals to create an efficient and intuitive payment journey.

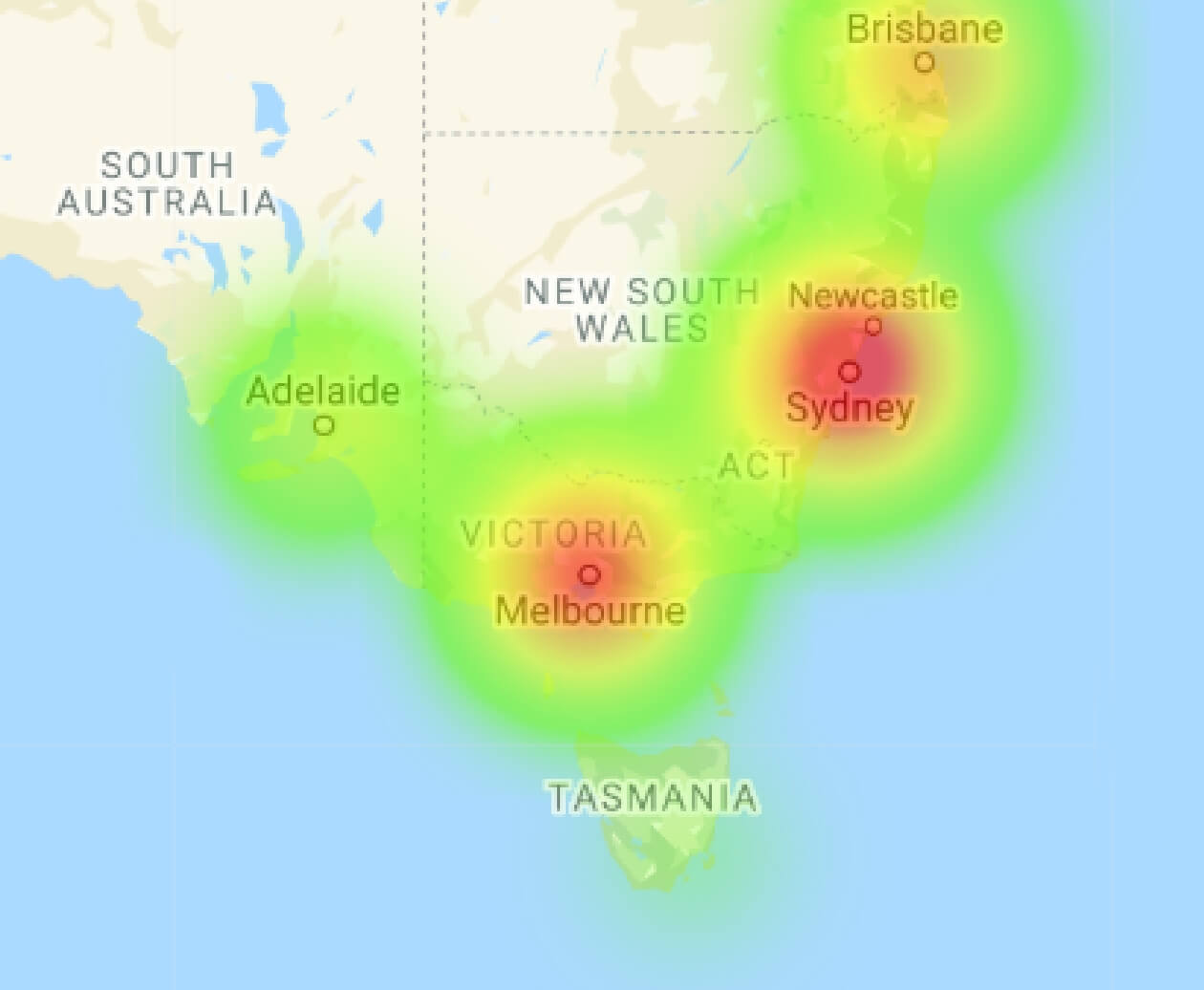

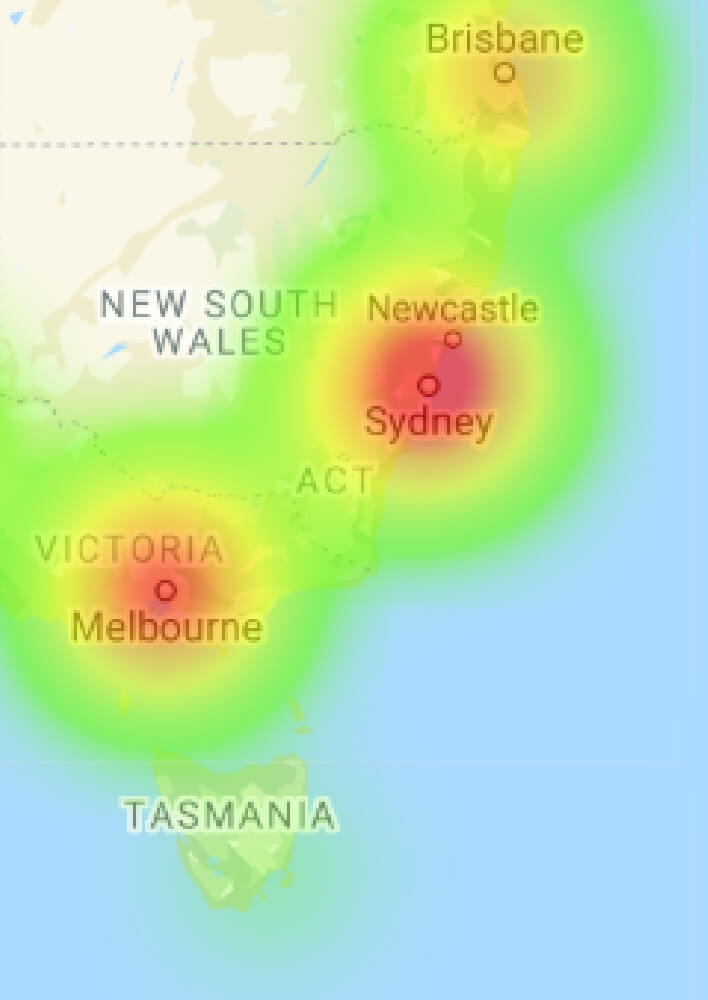

We work with childcare, education, health & fitness, sports clubs, hair & beauty, professional services and subscription businesses. We understand these industries and how to create the perfect payment solutions.

If you want to spend less time chasing direct debits and more time managing your business – then Payleadr is the solution you need.